Latest Businesses for Sale

The Added Value of HELVIA

Vademecum on Sale

Everything you need to know before setting out. Caveat and basic requirements for a safe, convenient and secure transfer.

Resources and Skills of HELVIA

National and global network of thousands of Buyers and Investors. Confidential technology platform, expertise and M&A best practices.

HELVIA’s Sell-side Methodology

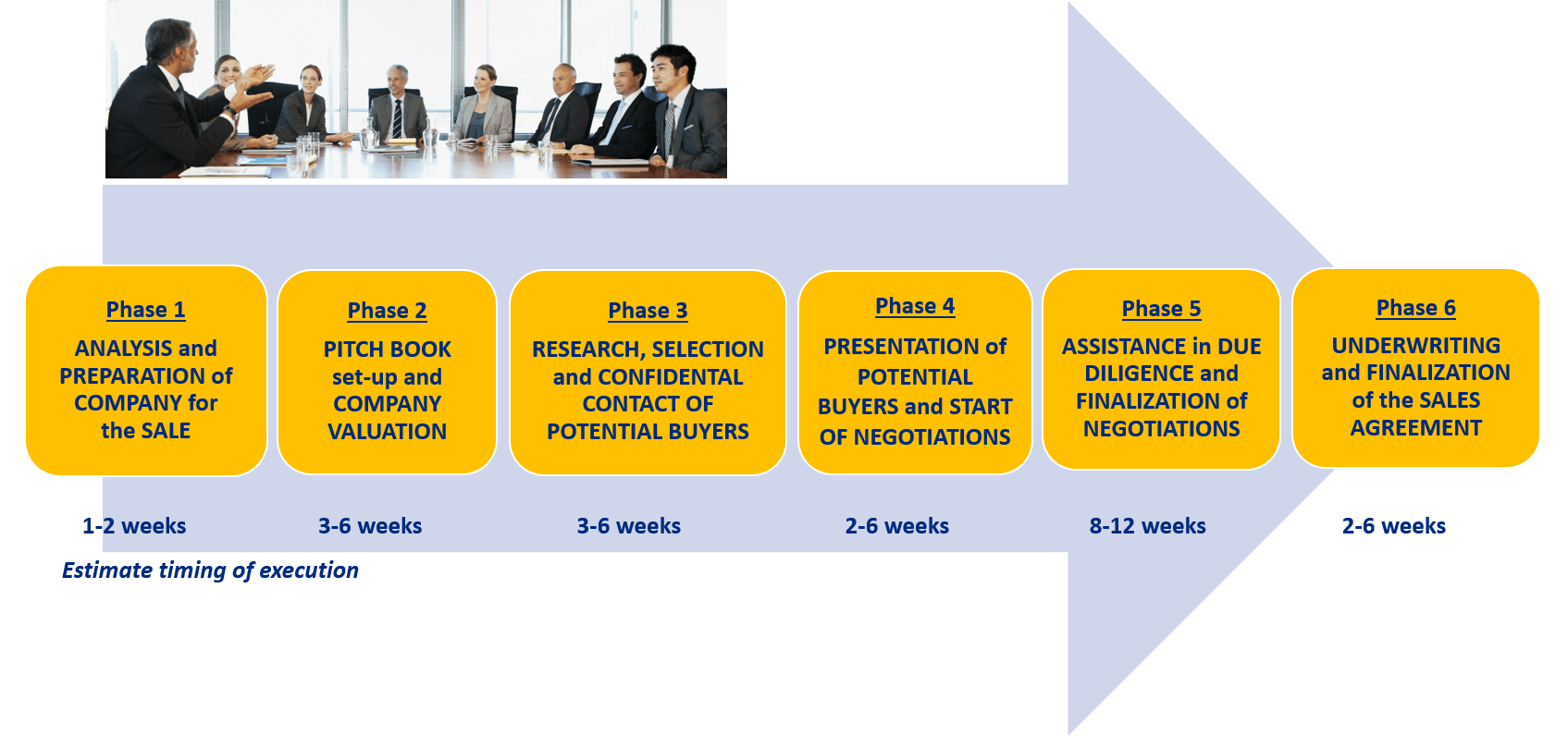

THE BUSINESS SALE PROCESS

From the PREPARATION of the Business to the finalisation of the ASSIGNMENT AGREEMENT

Step 1: ANALYSIS and PREPARATION OF THE BUSINESS FOR SALE

1.1. Exclusive assignment by the Client and project kick-off

1.2. Survey of the objectives, criteria and modalities of the sale of the company or property expected by the Client and verification of its readiness to accompany the prospective purchaser in the entrance phase

1.3. Gathering and examination of summary information, deeds and fundamental documents relating to the company or property for sale, as well as the structure and current dynamics of the competitive environment

1.4. Verification of strategic coherence, economic-financial, organisational self-sufficiency, of possible constraints or threats weighing on the object for sale or on the selling party, of acceptable or unacceptable risks on the part of the client

1.5. Formulation of the strategy for the sale of the business or property and the possible ways of executing the transaction

1.6. Gathering of all information, deeds, documents and reports available from the Client concerning the historical and current management of the business or property

1.7. Gathering of all available information, deeds, documents and reports from the Client concerning the multi-year strategic plan for the growth of the business or development/valorisation of the property and the respective financial plan

1.8. Identification of the Client’s employees and consultants of possible support to the sales activity and assignment of their respective responsibilities and tasks

1.9. Refinement of the timetable for the execution of the sales project

1.10. Presentation to the Client of HELVIA’s strategy and recommendations to best prepare the company or property for sale

Step 2: PITCH BOOK and COMPANY EVALUATION

2.1. Analysis and elaboration of the information, deeds, documents and historical and prospective reports collected concerning the company or property for sale, according to the precepts of international best practices in order to prepare an exhaustive and useful “information package” (pitch book) that can allow a correct strategic and economic evaluation by potential buyers and the bankability of the related acquisition financing with the banking system

2.2. Preparation and presentation of the Confidential Information Memorandum (CIM) to the Client, in national or foreign language, to be delivered at a later stage to the potential purchasers who will express a real interest in the acquisition of the company or property, subject to their signature of a Confidentiality Agreement (Not Disclosure Agreement – NDA)

2.3. Drafting of the Confidential and Personal Communication of the HELVIA Trustee and the Investment Teaser of the company or property for sale (anonymous and untraceable – in domestic and foreign languages) to be subsequently transmitted to the beneficial owners, legal representatives or M&A managers (decision-makers) of the selected potential buyers

2.4. Publication (unless otherwise advised by the Client) of the Confidential Sale Announcement of the company or property on HELVIA’s online M&A portal www.proinvesto.it and on HELVIA’s multiple social channels and linked sites

2.5. Drafting and presentation to the client of the Valuation Report of the Economic Working Capital of the company (financial valuation) and determination of the objective value on the basis of the criteria recommended by doctrine and professional practice

2.6. Property appraisals, if necessary, are entrusted to external professionals we trust or trusted by the Client

Step 3: SEARCH, SELECTION and CONFIDENTIAL CONTACT of POTENTIAL BUYERS

3.1. Meeting with the Client to collect potential purchasers “liked” (to be solicited) or “disliked” (not to be solicited) and to agree on the modalities of confidential contact of the decision-makers of the selected potential purchasers

3.2. Research and selection of potential purchasers (market intelligence) according to the target profile and geographical area agreed with the Client and identification of the names and confidential contact details of the decision-makers

3.3. Extension of the search and selection of potential buyers to potential buyers and investors of the ProInvesto Deal Club already in HELVIA’s portfolio

3.4. Contact and transmission of HELVIA’s confidential and personal communication and the (anonymous) investment teaser of the company or property for sale to the decision-makers of the selected potential buyers or investors

3.5. (Multiple) solicitation of the decision-makers by HELVIA, asking them (non-bindingly) if they would consider acquiring or investing in the proposed company or property

3.6. Collection of feedback from the decision-makers contacted and verification of the real degree of interest in evaluating the acquisition opportunity presented by HELVIA

3.7. Delivery of the confidential information memorandum and any other ancillary documents (addendum, video, sample, etc.) to the decision-makers who have declared their interest in evaluating the potential acquisition of the company or property, after signing the Confidentiality Agreement (NDA) as a guarantee for the Client

3.8. Gathering and responding to requests for clarification/detailed information received from interested decision-makers, in close collaboration with the Client

3.9. Presentation to the Client of the collected responses and the final outcome of the campaign of confidential contacts of potential buyers carried out by HELVIA

Step 4: PRESENTATION OF POTENTIAL BUYERS and LAUNCHING OF TRANSACTIONS

4.1. Organisation of cognitive meetings between the Client and potential purchasers

4.2. Verification of objectives, investment criteria and implementation methods by the potential purchaser

4.3. Verification of the potential purchaser’s reputation, financial soundness and possible contribution to the company’s growth

4.4. Assistance in preliminary negotiations with potential purchasers

4.5. Presentation of the financial valuation and justification of the sale price requested from the potential purchaser, in the light of the “objective value” of the company and the potential synergies achievable by the potential purchasers

4.6. Negotiation assistance on the vision of business development by the potential purchasers, on the contractual structure of the transaction, on the implementation methods and timing of the possible sale agreement

4.7. Collection of feedback and indicative offers submitted by potential purchasers

4.8. Drafting of LOI/MOU/TS non-binding agreements (letter of intent, memorandum of understanding, term sheet) and any revisions to the initial agreements or drafting of moratorium agreements

4.9. Negotiation assistance on the individual points of the non-binding LOI/MOU/TS agreements under discussion with the potential buyer, including possible price or pricing system, possible contractual terms, confidentiality constraints (strictly classified information), possible BCL requests, applicability of possible penalties in the event of counterparty abuse, etc.

4.10. Final drafting of LOI/MOU/TS non-binding agreements and collection of signatures from the client and the potential buyer

Step 5: DUE DILIGENCE and FINALISATION OF TRANSACTIONS

5.1. Planning, organisation and monitoring of the data room and of the various due diligence activities required by the Client (commercial, financial, tax, legal, labour, real estate, IT, environmental, etc.).

5.2. Assisting the Client and prospective Purchasers (and their trusted advisors) in carrying out the due diligence with regard to the collection, representation, interpretation and response of information, the handling of highly sensitive information, the examination and resolution of critical issues, etc.

5.3. Confrontation with the Client and potential purchasers regarding the findings of the due diligence, the possible divestment strategy and the estimated value of the business or property for sale (value bridge)

5.4. Execution of professional assignments (à la carte) requested by the Client to support the due diligence activities or the valuation of the company/property or the contractualisation of assets or ancillary services, such as: business plans, financial forecasts, research and clarification of potential synergies, outsourcing of activities, tax rulings, tax, customs and financial optimisation, etc.

5.5. Professional assistance in settling any disputes or outstanding issues from a legal, labour, tax, administrative, etc. perspective.

5.6. Guidance and negotiating assistance in the finalisation of the agreement, evaluation of options, exchange of concessions, management of stalls, option rights, pre-emptions, drag rights, earn-outs, representations and warranties, indemnities, etc.

5.7. Professional and negotiating assistance in defining the terms and conditions of the sale and purchase agreement (Sale & Purchase Agreement – SPA) and any ancillary contracts (Shareholders’ Agreement – SHA; Option Rights Agreement – ORA; leases of commercial real estate; use of patents/brands; employment or consultancy contracts, etc.), as well as in the negotiation of the terms and conditions of the sale and purchase agreement (Sale & Purchase Agreement – SPA).

Step 6: SUBSCRIPTION and PERFORMING OF THE ASSIGNMENT AGREEMENT

6.1. Assistance to the law firm during the drafting/revision of the sale/acquisition agreement (SPA – Sales & Purchase Agreement), on various topics such as: earn-out and ratchet clauses, representations and warranties, indemnity and loss of profit clauses, payment deferrals and price adjustment/renegotiation clauses, covenants, way-out and clearance clauses, conventional and legal remedies, contractual responsibilities and indemnity obligations of the buyer, seller’s default and cancellation due to fraud, etc.

6.2. Assistance to the law firm in the drafting/revision of any shareholder’s agreements (Shareholder’s Agreement) or agreements granting option rights (Put & Call Option Rights Agreement), on various topics, such as modalities and timing for the transfer of shares, powers and decisions to manage the company, co-sale or drag-along rights (tag-along rights, drag-along rights), material breach clauses, standstill periods, asset drainage, dividend distribution, enforceability of options, price adjustments, collars & caps price limits, non-competition agreements, conciliations and mediations, liquidated damages, dispute resolution, etc.

6.3. Assistance to the law firm in the drafting/revision of corporate deeds or other ancillary contracts, such as: new company statutes, revocation and appointment of directors, pledges and escrow deposits, share capital increases, shareholders’ loans, commercial leases of capital properties, employment contracts or vendor consultancy, trademark or patent licences, etc.

Organising and assisting in the signing (Signing) and finalisation (Closing) of the main sale/acquisition agreement and any subsequent price adjustment/adjustment stages.

How HELVIA can help you

Business or Property

Sell-side Engagements

Sell your Company or Property with HELVIA. Through our M&A expertise and global buyers network, we help you to monetise your asset, giving continuity to your business.

Representation & Administration Agreements

Do you have an impediment to search a buyer and sell your company? On your behalf, HELVIA can search the most appropriate purchaser, negotiate and close the sales deal.